October 2024, The Technology & Software industry sector team of Blue Tree Group – Investment Banking successfully advised key investors – MTIP, with participation from Elaia and early-stage investors Heran Partners, BTOV/ MATTERWAVES – of Belgian AI-powered clinical data platform, LynxCare, in M&A Market Sounding. Founded in 2015 by Georges De Feu and Dries Hens, […]

September, 2024. Blue Tree Group is a Munich-based boutique financial advisory firm, specialising in valuations, financing, and M&A transactions for mid-market companies and fast. growing firms across the German-speaking and Benelux regions. The firm is organised into two dedicated industry sector groups: Consumer, Retail & Services and Technology & Software, ensuring focused expertise tailored to […]

Blue Tree Group is an investment banking boutique based in Munich, Germany, with a strong focus on mid-sized and fast-growing “technology-enabled” businesses. Blue Tree Group – Investment Banking frequently advises in international m&a buy- and sell-side transactions as well as in equity and debt financings. It commands three industry focused sector teams which are dedicated […]

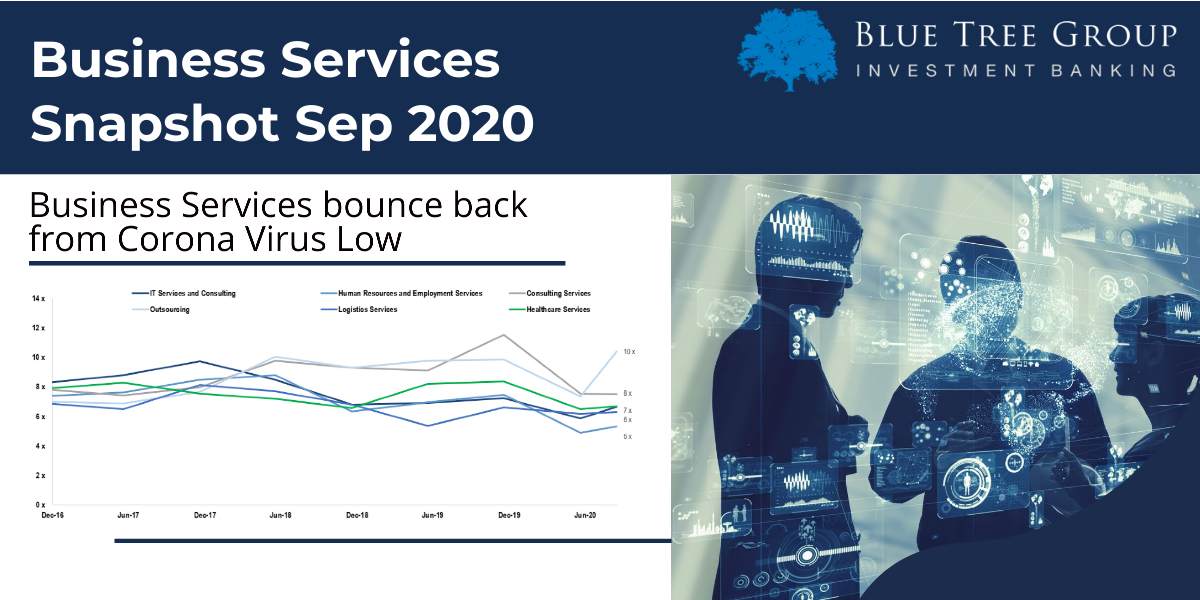

Click on the following link to find out more about the Business Services industry: https://bluetreegroup.de/download/valuation-snapshot-business-services-q4-2020/?wpdmdl=2888&refresh=6026b7e1800681613150177

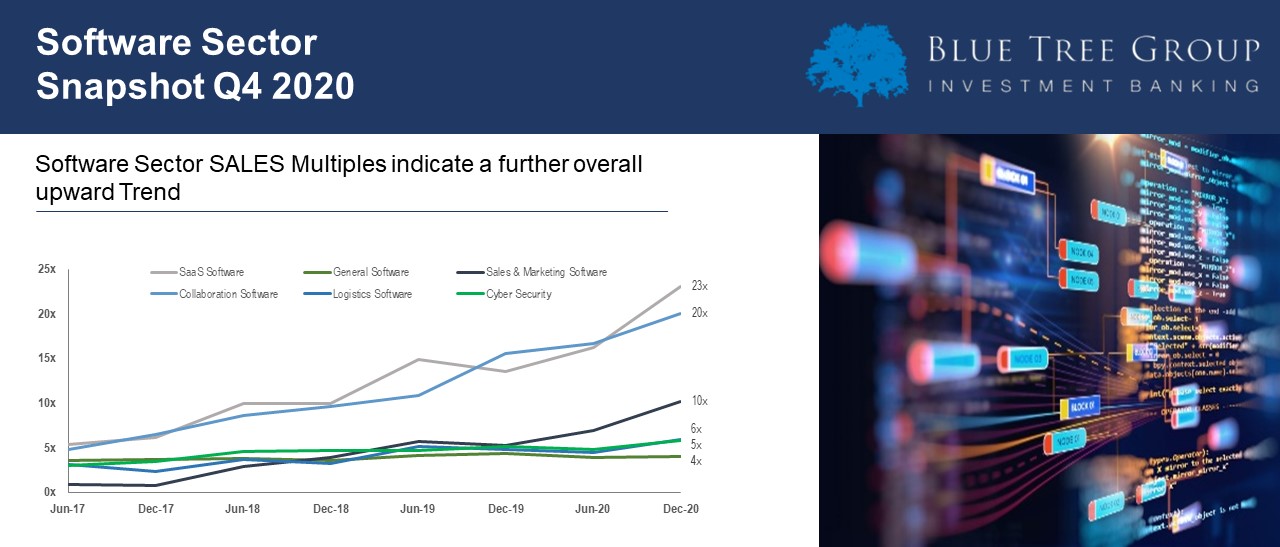

Click on the following link to find out more about the Software Industry: https://bluetreegroup.de/download/valuation-snapshot-software-q4-2020/?wpdmdl=2882&refresh=60141a4e265851611930190

Click on the following link to find out more about the media sector: https://bluetreegroup.de/download/valuation-snapshot-media-q4-2020/?wpdmdl=2870&refresh=5fca4e64345f01607093860

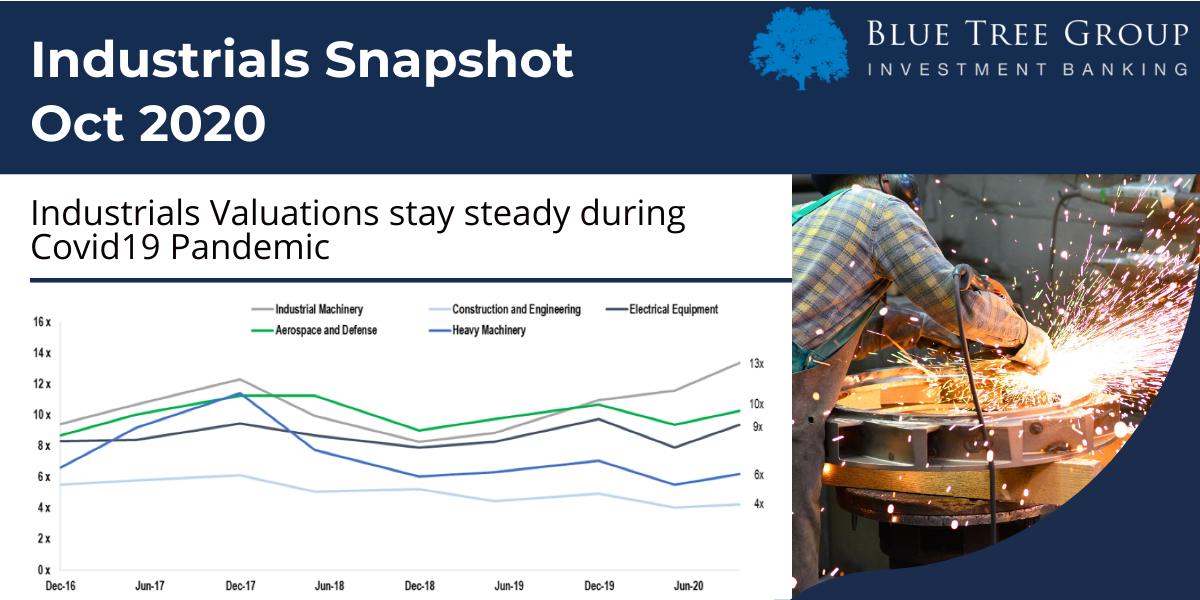

Click on the following link to find out more about the industrials sector: https://bluetreegroup.de/download/valuation-snapshot-industrials-q4-2020/?wpdmdl=2861&refresh=5f8adeb8c44a11602936504

Click on the following link to find out more about the consumer products sector: https://bluetreegroup.de/download/valuation-snapshot-consumer-products-q4-2020/?wpdmdl=2852&refresh=5f804d7213d591602243954

Click on the following link to find out more about the automotive sector: https://bluetreegroup.de/download/valuation-snapshot-automotive-q3-2020/?wpdmdl=2834&refresh=5f76dba6c8e581601624998

Click on the following link to find out more about the business service sector: https://bluetreegroup.de/download/2829/?wpdmdl=2829&refresh=5f6da31c9ae2d1601020700

MUNICH – September 5, 2023 – The entire team at Blue Tree Group – Investment Banking extends a warm welcome to Dr. Robert Wagner as the new Senior Industry Sector Advisor for the areas of „Digital Commerce and Direct to Consumer.“ Robert will be supporting our Industry Team, „Consumer, Retail and Services,“ in acquiring new […]

„Die Expertise der Blue Tree Group in der Finanzmodellierung und der Gestaltung von Kapitalstrukturen für Wachstumsunternehmen in Verbindung mit ihrem fundierten Branchen-Know-how über Konsumgütermarken hat uns geholfen, die Strukturen und Bedingungen mit unserem Finanzpartner zügig auszuhandeln.“ .ie umfangreiche Erfahrung und das tiefe Verständnis der Medienbranchen des TMT- Teams von Blue Tree Group hat uns geholfen, […]

Unternehmen: Oney Bank S.A ist eine französische und eine 100%ige Tochtergesellschaft der Auchan Holding. Oney Bank S.A. ist ein Spezialist in Point of Sale Financing in Europa. Situation: Im Rahmen der geplanten europäischen Expansion sollte ein strategischer Partner mit einem gemeinsam skalierbaren FinTech Produkt gefunden werden. Hierfür sollte ein gemeinsames Joint Venture gegründet werden, in […]

Die umfangreiche Erfahrung und das tiefe Verständnis des TMT- Teams von Blue Tree Group hat uns geholfen, einen „Der häufige Austausch der Blue Tree Group mit Entscheidern führender Softwareunternehmen in Europa und den USA in Verbindung mit dem tiefen Verständnis der Industrie 4.0 Softwarebranche hat massiv zum erfolgreichen Trade Sale der Industrial Analytics IA GmbH […]

„Die Expertise der Blue Tree Group in der Finanzmodellierung und der Gestaltung von Kapitalstrukturen für Wachstumsunternehmen in Verbindung mit ihrem fundierten Branchen-Know-how über Konsumgütermarken hat uns geholfen, die Strukturen und Bedingungen mit unserem Finanzpartner zügig auszuhandeln.“ . Albana Rama, CEO und Gründerin – The Raiforest Company AG Unternehmen: The Rainforest Company ist der europäische Pionier […]